Dow Jones Falls Under Key Level As Oil Stocks Pop

The Dow Jones fell below a key level as oil stocks saw a boost. The Dow Jones Industrial Average dropped below a significant level, while oil stocks experienced a surge, leading to a volatile market.

This decline in the Dow Jones marks a significant shift in the economic landscape, raising concerns for investors and financial analysts. As oil prices rose, several oil companies saw increases in their stock values, driving industry projections and prompting market fluctuations.

Factors influencing this market behavior include global supply and demand dynamics, geopolitical tensions, and shifts in energy policies. Amidst these developments, investors closely watch the movements of the Dow Jones and oil stocks for potential investment opportunities and market trends.

Dow Jones Tumbles Below Key Support Level

The Dow Jones index tumbles below a significant support level as oil stocks surge, creating a downward trend in the market.

The Dow Jones Industrial Average, a key indicator of the performance of the US stock market, has recently experienced a significant downturn, falling below a crucial support level. This decline has been influenced by various factors including market volatility, economic indicators, and investor sentiments.

In this section, we will explore the impact of these elements on the Dow Jones and analyze their implications for the broader market.

Market Volatility And The Downtrend:

- Market volatility has been a significant contributing factor to the recent downward movement of the Dow Jones.

- High levels of uncertainty and fluctuations in the market have resulted in increased selling pressure on stocks, leading to the decline in the index.

- Volatile market conditions can be triggered by various events such as geopolitical tensions, economic data releases, or unexpected developments in global markets.

Impact Of Economic Indicators On The Dow Jones:

- Economic indicators play a crucial role in shaping investor expectations and market sentiment, which, in turn, affect the performance of the Dow Jones.

- Key economic indicators such as GDP growth, employment data, inflation rates, and consumer confidence can provide insights into the overall health of the economy.

- Positive economic indicators often lead to increased investor confidence and bullish market sentiment, resulting in upward momentum for the Dow Jones. Conversely, negative economic indicators can trigger a bearish sentiment and contribute to the downtrend.

Investor Sentiments And Market Performance:

- Investor sentiments, driven by various factors such as market news, political developments, and central bank policies, have a significant impact on market performance, including the movement of the Dow Jones.

- Positive sentiments, characterized by optimism and risk appetite, can drive buying activity and push the index higher.

- Conversely, negative sentiments, driven by concerns over economic conditions or geopolitical risks, can lead to selling pressure and a decline in the index.

The recent downturn of the Dow Jones below a key support level can be attributed to market volatility, the influence of economic indicators, and investor sentiments. These factors combined have created an atmosphere of uncertainty and caution among market participants, impacting the overall performance of the stock market.

As we navigate through these challenging times, keeping a close eye on market dynamics and understanding the interconnectedness of various factors will be crucial for investors and traders alike.

Oil Stocks Rally Amidst Global Economic Concerns

As global economic concerns grow, oil stocks rally and lift the market as the Dow Jones falls below a key level. Investors turn to oil as a safe haven amidst the uncertainty.

Amidst global economic concerns, oil stocks have experienced a significant rally, defying expectations. This surge in oil stocks can be attributed to various factors and market dynamics. In this section, we will delve into the factors driving this rally, the influence of commodity prices, and the correlation between oil stocks and global economic conditions.

Factors Driving The Surge In Oil Stocks:

- Supply and demand dynamics: The balance between oil supply and demand is a key driving force behind the surge in oil stocks. Factors such as geopolitical tensions, production cuts, and disruptions in supply can significantly impact oil prices and subsequently drive the increase in oil stocks.

- OPEC+ agreements: The agreements between OPEC and its allies, known as OPEC+, have played a crucial role in stabilizing oil prices and supporting the rally in oil stocks. These agreements involve coordinated production cuts to maintain a balance in the global oil market.

- Economic recovery hopes: Optimism regarding the global economic recovery has also contributed to the surge in oil stocks. As countries gradually ease COVID-19 restrictions and economic activities rebound, the demand for oil and energy commodities has increased, amplifying the rally in oil stocks.

Commodity Prices And Their Influence:

Commodity prices, particularly the price of oil, exert a significant influence on the performance of oil stocks. Here are some key points to consider:

- Oil price volatility: Fluctuations in oil prices can directly impact the value and trading patterns of oil stocks. As oil prices experience volatility, investors closely monitor these fluctuations and adjust their positions accordingly.

- Resource-rich regions: Commodity prices are often influenced by geopolitical events and developments in resource-rich regions. Political instability or conflicts in major oil-producing countries can create supply disruptions, leading to price spikes and impacting oil stocks.

- Inflation and currency exchange rates: Commodity prices, including oil, are influenced by inflation rates and currency exchange rates. Changes in these factors can affect the cost of production, transportation, and global demand for oil, consequently impacting oil stocks.

Correlation Between Oil Stocks And Global Economic Conditions:

Oil stocks have a strong correlation with global economic conditions, reflecting the overall health of the global economy. Consider the following:

- Economic growth and energy demand: The state of the global economy, including GDP growth rates and industrial activity, has a direct impact on energy demand. As economies expand, the demand for oil and energy increases, leading to an upward trend in oil stocks.

- Investor sentiment and market performance: Oil stocks are subject to investor sentiment and overall market performance. During periods of economic uncertainty or market volatility, oil stocks may experience downward pressure due to fear and risk aversion. Conversely, during periods of economic stability and positive market sentiment, oil stocks tend to rise.

- Trade and global alliances: Trade policies and global alliances also influence the correlation between oil stocks and global economic conditions. Trade agreements, sanctions, and tariffs can affect the flow of oil and energy commodities, impacting oil stock prices.

As the global economic landscape continues to evolve, keeping an eye on these key factors and their influence on oil stocks can provide valuable insights for investors and market participants. The rally in oil stocks amidst global economic concerns showcases the complex dynamics between oil prices, market forces, and investor sentiment.

Analyzing The Impact Of Dow Jones Decline On Investment Strategies

The decline of the Dow Jones below a critical level has led to the analysis of its impact on investment strategies, especially as oil stocks show a positive trend. This article explores how this decline has influenced investment decisions and provides insights into potential strategies for navigating this challenging market.

**Dow Jones Falls Under Key Level As Oil Stocks Pop**

As the Dow Jones Industrial Average (DJIA) dips below a crucial threshold and oil stocks experience a surge, it becomes essential for investors to analyze the potential impact of these developments on their investment strategies. In this blog post, we will delve into the various aspects that should be considered when navigating a declining market, including investment opportunities, portfolio adjustment, and risk management.

By understanding these factors, investors can make informed decisions and potentially enhance their investment outcomes.

Investment Opportunities During A Market Downturn:

- Undervalued stocks: Identify stocks that are currently trading at a lower price than their intrinsic value. Such stocks may offer substantial potential for growth once the market stabilizes.

- Dividend-paying stocks: Consider investing in companies that consistently provide dividends, as these cash distributions can offset potential losses during a market decline.

- Sector rotation: Examine sectors that are less susceptible to market downturns and explore investment opportunities within those sectors.

Adjusting Portfolios Amidst Market Volatility:

- Regular review: Continuously monitor your portfolio and make necessary adjustments based on market conditions. Rebalancing helps maintain the desired allocation and manage risk.

- Maintaining a long-term perspective: Avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on long-term financial goals and consider market downturns as potential buying opportunities.

- Stop-loss orders: Implement stop-loss orders to automatically sell stocks if they reach a predetermined price. This strategy helps limit losses and protect investment capital.

Portfolio Diversification And Risk Management:

- Asset allocation: Diversify investments across various asset classes, such as stocks, bonds, and commodities, to reduce vulnerability to a single market.

- Geographic diversification: Invest in both domestic and international markets to mitigate country-specific risks and take advantage of global opportunities.

- Risk assessment: Regularly assess the risk profile of your investments and adjust accordingly. Consider incorporating risk management tools, such as options or futures contracts, to hedge against potential losses.

By proactively analyzing the impact of the Dow Jones decline on investment strategies, investors can position themselves to capitalize on opportunities and navigate market volatility more effectively. It is crucial to remember that while market downturns may generate uncertainty, they also present possibilities for strategic investment decisions.

Through a diversified portfolio, regular reviews, and risk management practices, investors can safeguard their wealth and potentially optimize their long-term investment outcomes

The Role Of Government Policies On Dow Jones Performance

Government policies play a crucial role in influencing the performance of the Dow Jones, as seen with the recent dip below a key level due to the increase in value of oil stocks. The impact of these policies on the market is a significant factor to consider for investors and traders.

————————————————–

The Dow Jones Industrial Average (DJIA) is one of the most influential stock market indexes in the world, often regarded as a barometer of the overall health of the U. S. Economy. It consists of 30 large, publicly traded companies that span various industries.

While several factors can impact the Dow’s performance, government policies play a significant role. Here, we explore the impact of fiscal and monetary policies on the stock market, government interventions during economic crises, and the connection between investor sentiment and government actions.

Impact Of Fiscal And Monetary Policies On The Stock Market:

Government policies related to fiscal and monetary matters can have a profound impact on the performance of the Dow Jones. Here are some key points regarding this relationship:

- Monetary policies, such as adjustments in interest rates and quantitative easing programs, influence the cost of borrowing and the availability of credit for businesses and consumers. These policies can impact the profitability of companies and the spending power of individuals, ultimately affecting the stock market.

- Fiscal policies, including tax reforms, government spending initiatives, and regulations, can significantly impact the overall economy and, in turn, the stock market. For example, tax cuts can boost corporate profits and stimulate economic growth, leading to an increase in stock prices.

- Investors closely monitor announcements and actions related to fiscal and monetary policies to assess their potential impact on the stock market. These policies can create opportunities and risks for investors, influencing their buying and selling decisions.

Government Interventions During Economic Crises:

During times of economic crises, governments often resort to various interventions to stabilize the stock market and prevent further turmoil. Here are some notable aspects of government interventions during such challenging times:

- Bailouts and stimulus packages: Governments may provide financial support to struggling industries, such as banks and automakers, to prevent their collapse and restore market confidence. These interventions aim to stabilize the economy and prevent a full-scale market crash.

- Regulatory measures: Governments can introduce new regulations or strengthen existing ones to enhance market transparency and alleviate systemic risks. Such measures aim to restore investor trust and ensure fair practices in the financial sector.

- Coordination with central banks: Governments work closely with central banks to implement monetary policies that counteract the negative effects of economic crises. This coordination aims to provide liquidity to financial institutions and stimulate economic activity.

In times of crisis, government interventions can have a mixed impact on the stock market. While they may offer short-term stability, their long-term effectiveness and unintended consequences are subject to ongoing debate.

Investor Sentiment And Government Actions:

Investor sentiment, the overall perception and attitude of investors towards the economy and financial markets, can be strongly influenced by government actions. Here are some key factors to consider:

- Confidence and certainty: Government policies that provide stability, predictability, and clarity can boost investor confidence. Favorable policies, such as tax incentives for investments or industry-specific subsidies, can attract investors and contribute to market growth.

- Economic indicators: Government-issued economic indicators, such as GDP growth rates, employment data, and inflation figures, provide valuable insights into the overall health of the economy. These indicators can impact investor sentiment and influence market trends.

- Global events and government responses: Government actions in response to global events, geopolitical tensions, or international trade disputes can significantly impact investor sentiment. Investors closely monitor how governments navigate these challenges and adjust their investment strategies accordingly.

Understanding the relationship between investor sentiment and government actions is crucial for analyzing the potential impact of government policies on the Dow Jones and other stock market indexes.

Government policies play a pivotal role in shaping the performance of the Dow Jones and the broader stock market. Fiscal and monetary policies, government interventions during crises, and investor sentiment are all interconnected factors that can influence market trends and investor behavior.

By keeping a close eye on government policies and their implications, investors can make informed decisions to navigate the ever-changing landscape of the stock market.

Understanding Key Technical Indicators For Dow Jones Analysis

Understanding key technical indicators is crucial for analyzing the Dow Jones, especially when it falls below important levels like the recent oil stock rally. By carefully studying these indicators, investors can make better-informed decisions about the market.

The Dow Jones Industrial Average (DJIA) has recently fallen below a key level, causing concern among investors. In this blog post, we will explore some important technical indicators that can help us analyze the performance of the Dow Jones. Understanding these indicators can provide valuable insights into market trends and potential opportunities.

Importance Of Support And Resistance Levels:

- Support and resistance levels are crucial price points that can indicate the strength or weakness of a stock or index like the Dow Jones.

- Support levels act as a floor for the price, preventing it from falling further, while resistance levels act as a ceiling, preventing the price from rising above a certain point.

- When the Dow Jones falls below a key support level, it suggests a bearish sentiment, indicating potential further declines. On the other hand, breaking above a resistance level indicates a bullish sentiment, signaling the possibility of future gains.

Moving Averages And Their Significance:

- Moving averages are widely used technical indicators that help in smoothing out price fluctuations, providing a clearer picture of the overall trend.

- The simple moving average (SMA) calculates the arithmetic mean of the closing prices over a specified period. It reveals the direction and strength of the trend.

- The exponential moving average (EMA) assigns more weight to recent prices, making it more responsive to recent market activity.

- When the current price rises above the moving average, it could indicate an uptrend, while a drop below the moving average may indicate a downtrend.

Macd And Rsi Indicators For Market Trend Assessment:

- The Moving Average Convergence Divergence (MACD) is a popular momentum indicator used to identify potential trend reversals.

- It consists of two lines, the MACD line and the signal line, along with a histogram that represents the difference between these lines.

- When the MACD line crosses above the signal line, it suggests a bullish trend, while a cross below the signal line indicates a bearish trend.

- The Relative Strength Index (RSI) measures the speed and change of price movements. It oscillates between 0 and 100, with values above 70 indicating overbought conditions, and values below 30 suggesting oversold conditions.

- Traders use the RSI to determine potential market reversals and to identify buying or selling opportunities.

Understanding these key technical indicators can help investors assess the performance of the Dow Jones and make informed decisions. Support and resistance levels, moving averages, MACD, and RSI are all valuable tools for analyzing market trends and identifying potential opportunities.

By incorporating these indicators into your analysis, you can gain a deeper understanding of the Dow Jones and navigate the complexities of the financial markets more effectively.

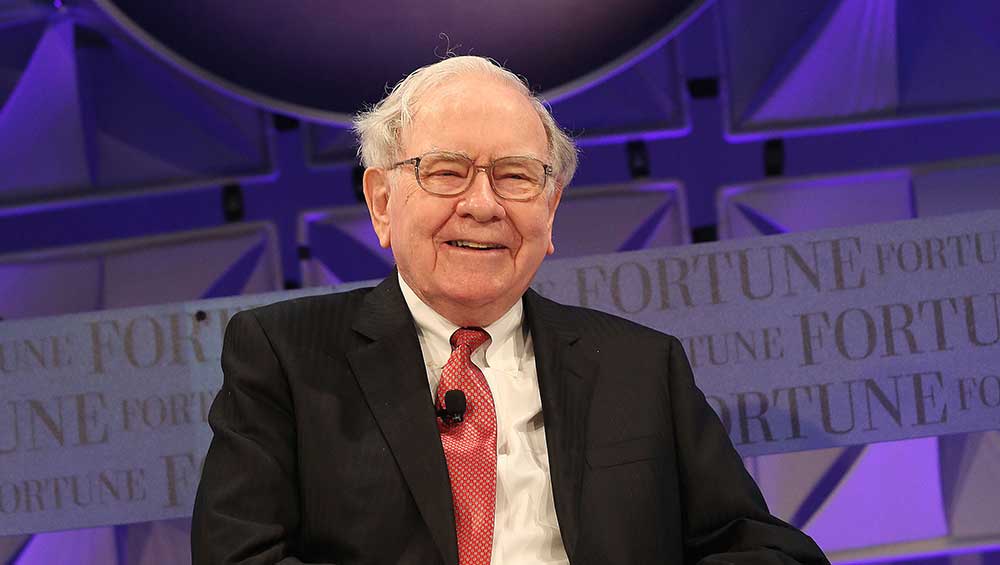

Credit: www.youtube.com

Mitigating Risks And Preparing For Market Fluctuations

Mitigating risks and preparing for market fluctuations is crucial as the Dow Jones falls below a key level while oil stocks soar. Being proactive in risk management strategies can help navigate the unpredictable nature of the market.

Strategies For Hedging Against Market Downturns:

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk. By including a mix of stocks, bonds, and commodities, you can mitigate the impact of market downturns on your overall portfolio.

- Invest in defensive stocks: Look for companies that provide essential goods or services, such as healthcare or utilities, which tend to be more resilient during economic downturns.

- Consider inverse ETFs: Exchange-traded funds (ETFs) that move in the opposite direction of the market can serve as a hedge against downturns. These funds aim to provide returns that are negatively correlated with the overall market.

- Use options strategies: Options can be used to protect your portfolio against downside risk. Purchasing put options on individual stocks or indices can act as insurance, allowing you to sell at a predetermined price in case of a market decline.

- Employ asset allocation: By adjusting your asset allocation based on market conditions, you can minimize the impact of market fluctuations. This involves reducing exposure to higher risk assets during periods of instability and increasing allocation to safer options like cash or bonds.

Setting Stop-Loss Orders And Risk Management Techniques:

- Implement stop-loss orders: A stop-loss order sets a predetermined price at which a security will be automatically sold, limiting potential losses. This technique helps protect your investments by ensuring that you exit a position if it reaches a specified downside level.

- Use trailing stop-loss orders: Trailing stop-loss orders adjust the selling price as the market value of the security rises, allowing you to capture additional gains while still protecting against significant losses.

- Apply proper position sizing: Ensure that the size of each position in your portfolio is appropriate based on your risk tolerance. Avoid overexposing yourself to any one investment, as it can significantly impact your overall portfolio if it underperforms.

- Regularly reassess risk exposure: Continuously monitor your portfolio to identify and manage any potential risks. Regularly reviewing your investments helps you stay proactive in adjusting your positions, reducing potential losses in times of market downturns.

Adapting Investment Strategies To Changing Market Conditions:

- Stay informed: Keep up with the latest news and trends impacting the market. Understanding market dynamics and macroeconomic factors can help you adapt your investment strategies accordingly.

- Be flexible: Adjust your investment approach to different market conditions. Consider a more conservative approach during economic downturns and a more aggressive one during periods of growth.

- Dollar-cost averaging: Regularly investing a fixed amount regardless of market conditions allows you to buy more shares when prices are low and fewer shares when prices are high. This strategy smooths out the effects of market volatility over time.

- Invest for the long term: Taking a long-term view can help you weather short-term market fluctuations. Focus on quality investments and avoid making impulsive decisions based on short-term market movements.

Remember, mitigating risks and preparing for market fluctuations is essential to protect your investments. By implementing these strategies, setting stop-loss orders, and adapting your investment approach based on changing market conditions, you can navigate through market uncertainties with confidence.

The Future Outlook For Dow Jones And Oil Stocks

The Dow Jones falls below a significant level as oil stocks experience a surge. The future outlook for Dow Jones and oil stocks appears uncertain amidst this contrasting market performance.

The stock market can be as unpredictable as the weather, with its ups and downs causing investors to closely watch their portfolios. One key area that has caught the attention of financial experts is the Dow Jones Industrial Average (DJIA) and the performance of oil stocks.

Here, we dive into the future outlook for Dow Jones and oil stocks, exploring the expert predictions on market recovery and potential growth, the factors influencing the long-term performance of Dow Jones, and the importance of monitoring oil prices and geopolitical events for investment decisions.

Expert Predictions On Market Recovery And Potential Growth:

- Financial experts anticipate a cautious yet optimistic recovery for the Dow Jones and oil stocks.

- The current global economic situation, including the COVID-19 pandemic and geopolitical tensions, creates uncertainty in the stock market.

- Despite challenges, experts project gradual growth and a potential rebound in the coming months.

Factors Influencing The Long-Term Performance Of Dow Jones:

- Monetary policies set by central banks, such as interest rates and quantitative easing, impact the overall performance of the stock market.

- Economic indicators, including GDP growth, inflation rates, and consumer confidence, play a vital role in determining the trajectory of Dow Jones.

- Technological advancements, disruptive innovation, and changing market trends can boost or dampen the performance of specific industries within the Dow Jones index.

- Geopolitical events, such as trade disputes, political instability, and natural disasters, can have a significant impact on the stock market’s long-term performance.

Monitoring Oil Prices And Geopolitical Events For Investment Decisions:

- Oil plays a crucial role in the global economy, and therefore, its prices can heavily influence the performance of oil stocks and, subsequently, the Dow Jones.

- Fluctuations in oil prices can be influenced by geopolitical tensions, production levels, supply and demand dynamics, and changes in global energy policies.

- Investors should stay informed about oil price trends and understand how these fluctuations might impact different sectors within the Dow Jones index.

- Keeping an eye on geopolitical events, such as conflicts in oil-producing regions or major policy changes, is essential to make well-informed investment decisions.

The future outlook for Dow Jones and oil stocks is subject to numerous variables, making it difficult to predict with absolute certainty. However, by closely monitoring expert predictions, understanding the factors influencing long-term performance, and staying informed about oil prices and geopolitical events, investors can navigate the stock market with greater confidence.

Remember, knowledge is power, and staying informed is key to making sound investment choices.

Frequently Asked Questions On Dow Jones Falls Under Key Level As Oil Stocks Pop

What Caused The Fall In Dow Jones Under Key Level?

The fall in Dow Jones can be attributed to several factors including economic uncertainty, geopolitical tensions, and negative market sentiment. Additionally, the impact of falling oil prices and the performance of oil stocks also played a significant role in the decline of Dow Jones.

Why Did Oil Stocks Pop Despite The Fall In Dow Jones?

The rise in oil stocks can be attributed to various reasons such as favorable market conditions, increased demand for oil, positive earnings reports from oil companies, and geopolitical factors affecting oil supply. These factors outweighed the negative impact of Dow Jones falling and contributed to the rise in oil stock prices.

How Does The Fall In Dow Jones Affect The Overall Market?

The fall in Dow Jones can have a ripple effect on the overall market. It can lead to a decrease in investor confidence, resulting in selling pressure across various sectors. Additionally, it may also impact consumer sentiment and business spending, affecting the overall economic landscape.

Is This A Temporary Dip In The Market Or A Long-Term Trend?

It is difficult to predict with certainty whether the fall in Dow Jones is a temporary dip or a long-term trend. Market conditions are influenced by numerous factors, and it is important to closely monitor indicators and economic developments to determine the direction of the market in the coming days and weeks.

Conclusion

To sum up, the Dow Jones has experienced a decline below the key level, which has been largely influenced by the surging oil stocks. This downward trend raises concerns about the overall stability of the market. Investors are closely monitoring the situation as they navigate through the potential implications of these developments.

As the oil stocks gain momentum, it is vital for market participants to carefully assess the risks and opportunities that lie ahead. The volatility in the energy sector significantly impacts the broader market, and it is vital for investors to gauge the potential impact of these movements on their portfolios.

This serves as a reminder of the interconnectedness of various sectors in the stock market and underscores the importance of diversification and risk management strategies. Keeping a close eye on market dynamics and staying informed about relevant events will be crucial for investors to make informed decisions and navigate these uncertain times.

Post Comment