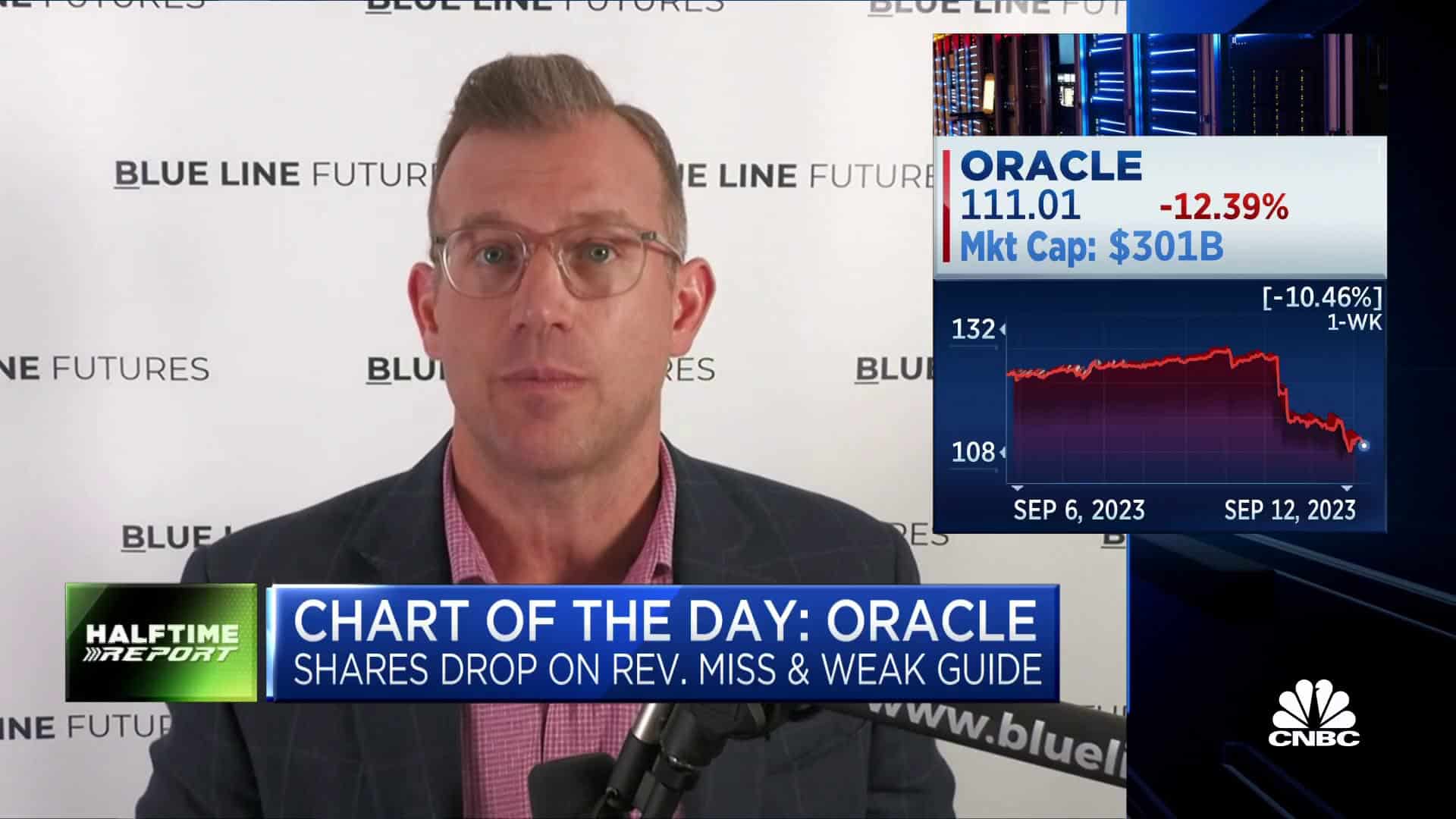

Oracle Stock Suffers Steepest Drop Since 2002 on Weak Revenue Guidance

Oracle stock experienced its sharpest drop since 2002 due to weak revenue guidance. This decline is a significant setback for the company and has raised concerns among investors.

We will analyze the reasons behind Oracle’s disappointing revenue outlook and explore the potential impact on its future prospects.

Weak Revenue Guidance Leads To 2002-Like Plunge

Oracle stock experiences its sharpest decline since 2002 due to weak revenue guidance, resulting in a plunge reminiscent of the earlier period.

The market shook as shares of tech giant Oracle experienced a sharp decline, resulting in the steepest drop seen since 2002. Investors were left disappointed and concerned by the company’s weak revenue projections, which contributed to the plunge in Oracle’s stock value.

Let’s explore the impact of this guidance on the company’s shares:

Shares Plummet As Oracle’S Revenue Projection Disappoints Investors:

- Revenue projection disappointment triggers a significant sell-off, causing Oracle’s stock to plummet.

- Investors react strongly to the weak revenue guidance, reflecting their concerns about the company’s future profitability.

- The market’s negative response highlights the importance of revenue guidance as a key metric for investors.

- The drop in Oracle’s stock serves as a reminder of the significant influence revenue projections have on investor sentiment.

Impact Of Weak Revenue Guidance On Oracle Stock:

- Declining revenue projections erode investor confidence, leading to an immediate decline in stock prices.

- Investor sentiment is heavily influenced by revenue forecasts, as they provide critical insights into a company’s growth prospects and financial health.

- The weak revenue guidance raises doubts about Oracle’s ability to generate sustainable revenue and maintain its competitiveness in the market.

- The dramatic plunge in Oracle’s stock demonstrates the market’s intensified concerns about the company’s future performance.

Oracle’s stock suffered its most severe decline since 2002, driven by disappointing revenue projections. The sell-off by investors indicates the critical role revenue guidance plays in shaping market sentiment. The weak revenue forecasts have raised concerns about Oracle’s future prospects, leading to a significant erosion of shareholder confidence.

Credit: www.nbcnewyork.com

Factors Contributing To Weak Revenue Guidance

Oracle’s stock experienced its sharpest decline since 2002 due to weak revenue guidance. Factors contributing to this decline include a slowdown in cloud services and stiff competition from rivals in the market. The company will need to address these issues to regain investor confidence.

Oracle, a leading software and technology company, recently experienced a significant drop in its stock value, the steepest decline since 2002. The company attributed this downturn to weak revenue guidance. In this section, we will analyze several factors that may have contributed to Oracle’s disappointing revenue forecast.

Economic Factors Affecting Oracle’S Revenue Forecast

- Sluggish global economic growth: With the global economy facing challenges and uncertainties, businesses across industries are becoming more cautious with their spending. This could have negatively impacted Oracle’s revenue forecast as companies could be scaling back on their technology investments.

- Currency fluctuations: Oracle operates in several international markets, and fluctuations in currency exchange rates can impact its revenue. Unfavorable movements in exchange rates can increase the cost of Oracle’s products and services for international customers, leading to lower demand and ultimately affecting revenue projection.

Analysis Of Oracle’S Market Position And Competition

- Increased competition: The technology landscape is highly competitive, and Oracle faces intense competition from both established players and new emerging companies. Competitors offering similar products and services can put pressure on Oracle’s market share and pricing strategies, impacting revenue projections.

- Evolving cloud computing market: The shift towards cloud-based solutions has transformed the software and technology industry. Oracle, like other established companies, has had to adapt its business model to remain relevant. However, this transition may have caused disruptions and challenges, affecting Oracle’s revenue projection.

Impact Of Changing Customer Preferences And Behavior

- Shifting customer preferences: As technology evolves, so do customer preferences. Customers now have a range of options to choose from, not only from Oracle but also from its competitors. The changing customer preferences towards different software and technology solutions can affect Oracle’s revenue forecast.

- Changing buying behavior: Customers have become more informed and discerning when making purchasing decisions. They may take longer to evaluate products and services, compare options, and negotiate deals. This elongated buying process can impact Oracle’s revenue projection, as it might take more time for potential customers to convert into actual sales.

Oracle’s weaker revenue guidance can be attributed to a combination of economic factors, market competition, and changing customer preferences and behavior. Navigating these challenges will require strategic adaptations and ongoing efforts to meet evolving customer needs and expectations in an increasingly competitive landscape.

Oracle’S Response And Future Outlook

Oracle’s stock experienced its largest drop since 2002 due to weak revenue guidance. The company is now focusing on its response and future outlook to recover from this setback and regain market confidence.

Oracle, a global technology company, recently faced a significant drop in its stock value, experiencing the steepest decline since 2002. This downturn was primarily a result of weak revenue guidance, leading investors and analysts to question the future prospects of Oracle’s stock.

In response to these challenges, Oracle has taken several steps to address the situation and create a more positive outlook. Additionally, industry experts have shared their predictions for Oracle’s future performance, offering insights into the company’s potential for growth. By evaluating these factors, we can gain a better understanding of the long-term prospects of Oracle stock.

Steps Taken By Oracle To Address Revenue Challenges:

- Enhancing product offerings and developing innovative solutions to meet evolving customer demands: Oracle has focused on refining its product portfolio and investing in cutting-edge technologies to strengthen its competitive position in the market.

- Expanding into cloud-based services: Recognizing the growing significance of cloud computing, Oracle has made strategic moves to boost its presence in this domain. By offering cloud-based solutions, the company aims to tap into new revenue streams and adapt to changing industry trends.

- Streamlining operations and cost management: Oracle has taken measures to optimize operational efficiency and reduce expenses. This includes consolidating certain operations, implementing cost-saving initiatives, and improving overall financial performance.

Analyst Predictions For Oracle’S Future Performance:

- Consistent revenue growth: Despite current challenges, analysts remain optimistic about Oracle’s long-term revenue growth potential. They expect the company to benefit from its investments in cloud technology and enhanced product offerings, which should drive customer adoption and increase sales.

- Emphasis on cloud-based services: Experts believe that Oracle’s strategic focus on cloud-based services will allow it to capture a significant share of the expanding cloud market. This transition is expected to contribute to future revenue growth and position the company as a key player in the industry.

- Potential for increased profitability: As Oracle continues to optimize its operations and reduce costs, analysts foresee an improvement in the company’s profitability over time. This, combined with the expected revenue growth, indicates a promising outlook for Oracle’s financial performance.

Evaluating The Long-Term Prospects Of Oracle Stock:

- Market resilience: While Oracle may currently face revenue challenges, the company has demonstrated its ability to adapt to market dynamics in the past. With its extensive product portfolio, global presence, and strong customer relationships, Oracle possesses the potential to overcome temporary setbacks and regain growth momentum.

- Technological advancements: Oracle’s commitment to innovation and its investments in emerging technologies provide a foundation for future success. By leveraging advancements in artificial intelligence, machine learning, and cloud computing, Oracle can position itself as a leader in the digital transformation era.

- Competitive landscape: The technology sector is highly competitive, and Oracle faces stiff competition from both established players and emerging startups. However, Oracle’s strong brand reputation, vast customer base, and comprehensive product offerings give it a competitive edge, enabling it to maintain its position as a key player in the industry.

Although Oracle’s stock experienced a significant drop due to weak revenue guidance, the company has taken proactive steps to address these challenges. With a focus on enhancing product offerings, expanding into cloud services, and optimizing operations, Oracle aims to improve its financial performance and create a more positive future outlook.

Analysts also project steady revenue growth, increased profitability, and market resilience for Oracle. Considering these factors, Oracle stock holds promising long-term prospects in the technology sector.

Frequently Asked Questions Of Oracle Stock Suffers Steepest Drop Since 2002 On Weak Revenue Guidance

Where Will Oracle Stock Be In 5 Years?

Oracle stock is projected to fluctuate in value over the next 5 years.

What Happened To Oracle Stock In 2000?

In 2000, Oracle stock experienced a decline, resulting in a significant drop in its value.

What Is The Stock Price Forecast For Oracle In 2023?

According to current data and analysis, it is not possible to accurately predict Oracle’s stock price for 2023.

What Is The Stock Price Forecast For Oracle In 2024?

According to the available data, the exact forecast for Oracle’s stock price in 2024 is uncertain.

Conclusion

Oracle’s recent steepest drop in stock since 2002 can be attributed to weak revenue guidance. The company’s lower-than-expected performance has raised concerns among investors and analysts alike. While Oracle continues to face challenges in the competitive market, it is crucial for them to address their revenue issues and work towards regaining stability.

The decline in stock price reflects the disappointment felt by shareholders, with the company now facing the pressure to implement strategies that will generate improved financial results. As the tech industry evolves rapidly, Oracle must adapt to changing market dynamics and seek innovative solutions to stay ahead.

It remains to be seen how Oracle’s leadership will navigate this challenging period and whether they can regain investor confidence with stronger revenue growth in the future. Only time will tell if Oracle can successfully face these hurdles and emerge as a stronger player in the market.

Post Comment